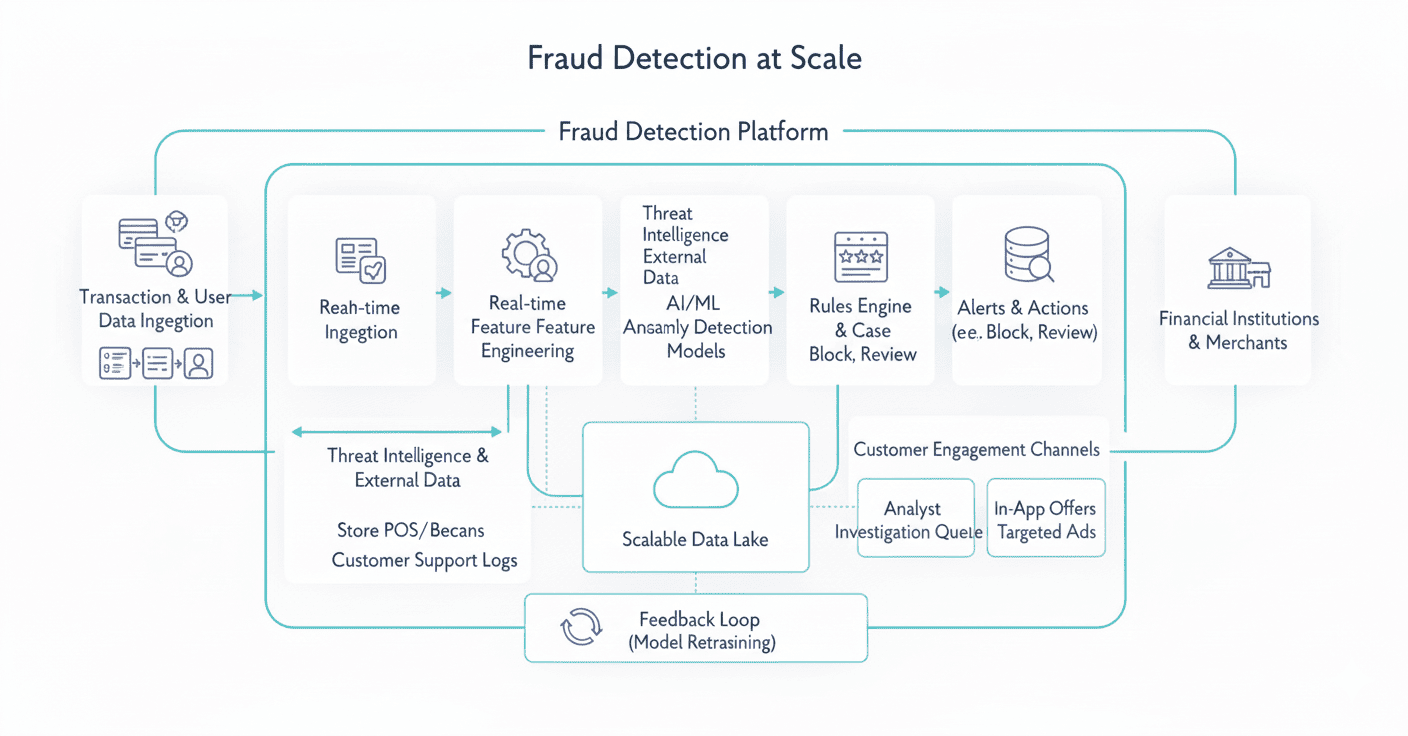

Fraud Detection at Scale: A 99% Accuracy Case Study

Real-time Financial Surveillance with Graph-Based AI

Company Profile

A leading global fintech with millions of daily transactions.

Industry

Finance & Banking

Region

Global

About the Client

Detection Accuracy

Inference Latency

Annual Losses Prevented

Challenge

Fraudsters have moved beyond simple stolen cards; they now use complex networks of synthetic identities and circular transactions. The client's existing systems lacked the "social" context of transactions.

The challenge was to analyze trillion-scale relationship graphs in real-time.

The outdated surveillance infrastructure resulted in critical vulnerabilities:

- High false-positive rates causing customer friction.

- Inability to detect networked or circular fraud patterns.

- Legacy systems unable to handle sub-15ms latency requirements.

- Massive operational costs for manual fraud investigation.

The organization needed a paradigm shift from transactional analysis to relational intelligence.

The Solution

Real-time Graph-AI Surveillance

The Outcome

Global Security & Compliance

Reduction in False Positives

Fraud Prevented Annually

Operational Cost Savings

"WebbyButter has set a new standard for security in our organization. We finally have a system that is as smart as the threats we face."

Continue Exploring

More Success Stories

Discover how we've helped leading global enterprises transform their operations through custom-engineered AI solutions.

Stay ahead of the curve

Receive updates on the state of Applied Artificial Intelligence.

Ready to see real ROI from AI?

Schedule a technical discovery call with our AI specialists. We'll assess your data infrastructure and identify high-impact opportunities.