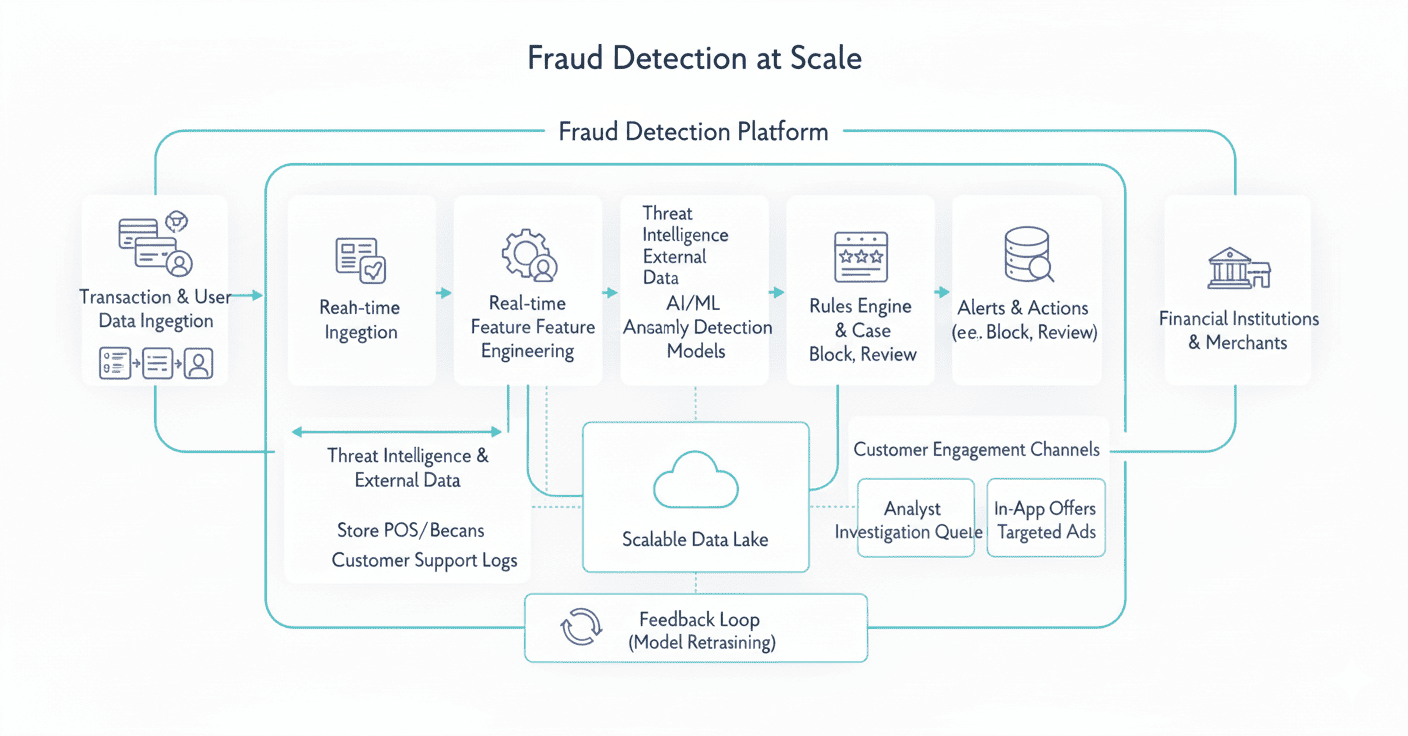

Fraud Detection at Scale: A 99% Accuracy Case Study

Real-time Financial Surveillance with Graph-Based AI

Company Profile

A leading global fintech with millions of daily transactions.

Industry

Finance & Banking

Region

Global

About the Client

Detection Accuracy

Inference Latency

Annual Losses Prevented

Challenge

Fraudsters have moved beyond simple stolen cards; they now use complex networks of synthetic identities and circular transactions. The client's existing systems lacked the 'social' context of transactions—they could only see individual events, not the relationships between them. This led to a high volume of false positives, frustrating legitimate customers, while sophisticated fraud 'rings' continued to operate undetected under the radar.

The challenge was to analyze trillion-scale relationship graphs in real-time. The sheer scale of the historical transaction data made it difficult to train models that were both accurate and fast enough for real-time inference. There was also a significant challenge in adapting to emerging fraud patterns, as the existing rule-based engines required weeks of manual tuning to react to new types of attacks. This delay created a window of vulnerability that was being actively exploited by organized cyber-criminal groups.

The outdated surveillance infrastructure resulted in critical vulnerabilities:

- High false-positive rates causing customer friction.

- Inability to detect networked or circular fraud patterns.

- Legacy systems unable to handle sub-15ms latency requirements.

- Massive operational costs for manual fraud investigation.

The organization needed a paradigm shift from transactional analysis to relational intelligence to secure their global ecosystem.

The Solution

Real-time Graph-AI Surveillance

The Outcome

Global Security & Compliance

Reduction in False Positives

Fraud Prevented Annually

Operational Cost Savings

"WebbyButter has set a new standard for security in our organization. We finally have a system that is as smart as the threats we face."

Continue Exploring

More Success Stories

Discover how we've helped leading global enterprises transform their operations through custom-engineered AI solutions.

Supply Chain Optimization

AI-driven route optimization and demand forecasting

Smart Factory Implementation

Industrial AI and IoT for predictive maintenance

Personalized Learning Platform

Adaptive learning system for enterprise education

Stay ahead of the curve

Receive updates on the state of Applied Artificial Intelligence.

Ready to see real ROI from AI?

Schedule a technical discovery call with our AI specialists. We'll assess your data infrastructure and identify high-impact opportunities.